Did you know that 82% of start-ups fail due to POOR CASHFLOW management? (Richard Branson, 2017).

The same seems to be happening with individuals. But just because you don’t make enough money to cover your expenses right now it doesn’t mean you have to throw your hands up in defeat. I suggest you to treat your household like a micro business and learn how to master the art of saving.

If you want your life to thrive financially, maybe you would like to keep an eye on the posts I will be sharing. Today, it is about how to control your cash-flow and start to enjoy life more.

MASTERING THE ART OF SAVING CAN HELP YOU TO PAY YOUR BILLS ON TIME

It can be depressing and frightening to realise that you don’t have enough cash to cover your weekly expenses. Without doubt, situations like these affect people emotionally (stress, anxiety, frustration,…) and can tempt you to want to look for quick fix solutions like credit cards. Ultimately, the credit cards will worsen the situation.

With ads making small loans sound like a simple process, people are easily attracted to this system to solve their cash problem. But this is just a quick fix, because the problem is still there. Stay away from credit cards!! Paying interest on credit cards not only suggests that you are living beyond your means, but it also means that you are losing money.

Accounting was my first career, and very early I found CASH FLOW MANAGEMENT being a regular concern for businesses owners and to overcome this uncertainty I suggested many times to work under a budget. Soon I started to apply this same management tool to my personal life.

It’s a SIMPLE SYSTEM, and I still use it until today. Actually, it became very handy when I moved to Australia. Living away from home with a restricted budget is not easy, but with some control you can better manage your priorities, pay the bills and even generate a surplus.

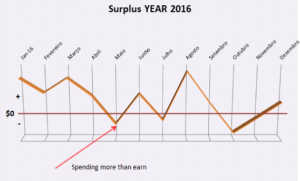

Fig. 1 – My spending behaviour in 2016

As you can see, May, July, October and November were months where the spending was more than the earnings. It is important to have sufficient savings to face these months. If the situation continues, you might need to review your expenses or think about a part-time job.

HOW TO BECOME FINANCIALLY FIT?

1 – Stay on top of your finances

Like in a business, poor cash flow is a huge problem. When you don’t have enough to pay your bills you get stressed and that impacts on your health and relations with your family, partner, and friends. Because you are under stress, your emotions are out of control and conflict escalates easily.

But it doesn’t need to be like this! Start with a budget plan. Take time to reflect on your expenses and sources of incomes and start to fill the plan.

2 – Saving culture

This subject is quite interesting. Some people see “saving” as depriving them from enjoying life, but doesn’t need to be the case! You see, 88% of rich people said that saving money was incredibly important to their success (Jeff Desjardins, 2017). The more you save the more you can invest and make more money. And it is not about accumulating things, instead devote more time to people and experiences.

Overspending and buying material things to impress others provides short-term happiness with long-term prices to pay, Craig Guillot (2013) says. Stop caring about the Joneses and what they have!

Do not save what is left after spending, spend what is left after saving. – Warren Buffet

3 – Be prepared

Life is not always going to go as planned, but there is always a solution. For example, if you go over the budget one week/month don’t stress, find a solution to fix it, and get back on track. There is no point to complain; whatever it is, it has already happened, just concentrate your energy on solutions. Sometimes things just happen!

The other day I had a flat tyre and had to buy 2 new tyres. I didn’t budget for that, but it happened and I had to fix it. I used my savings, now I need to manage to recover and get back on track again. The first step is to review the priorities for the coming weeks.

Define a week or monthly figure for your savings and put that amount aside in a savings account. Increase the amount every time you can. Having savings gives you the FREEDOM you need to be able to make choices.

4 – Prioritise

When you are thinking to buy a non-essential item, stop and think twice. Ask yourself: how many times am I you going to use this item? Do I really need it? Wait 24hours until you make the decision.

If you buy things you do not need, soon you will have to sell things you need. – Warren Buffet

5 – Have your own budget

Budgets sound like they are no fun, but having a budget is really important. Do it and do it well and you will gain the benefits over the term. I can show you a simple way.

Recommendations:

- Stick to the budget. For example, when you go shopping be aware how much you can spend and stick to that a amount

- Review your budget if your personal circumstances change

- Every 3 to 6 months redo your budget to make sure it reflects your current income, spending and what you want to achieve

- Check your bank statement regularly, just because faults do happen.

6 – (EXTRA) Check your mindset

All these steps can be implemented, but if you don’t change your current mindset you’re leading yourself to failure in a long run. WHY? Because your mind likes what’s familiar to you. If you experienced money struggles all your life, your mind associates that as familiar to you, and will work ways to keep you there. Again, your mind cannot distinguish between good or bad.

But, this can be changed! I suggest you to learn how to change your relationship with money and become financially fit.

With your finances under control your are now in a much better position to enjoy any extravagances. Buy or do something that you enjoy because you DESERVE IT!

If you know anyone who would find this useful, could you please share with them?

Useful downloads, click below:

Your Friend,

Disclaimer: I am not a financial advisor, and I suggest you to find a qualified advisor if your situation involve more serious matters. I am a qualified Accountant and I’ve made great strides in getting my finances under control. These recommendations are based on my own experience.

You may also like:

Hi there!! I’m an open-minded being, lifelong learner, positive, heart-centred, relationships – oriented, social change agent and well-being advocate. I’m committed to make my life shine every single moment and I’m inviting you to do the same.

My philosophy is to live life with passion and purpose that includes to make a positive contribution for a better world, starting with simple gestures. Join me on this journey.♥♥♥

*** Ricardina Silva ***

Very helpful information. In the current economic climate circumstances can change in a heartbeat. A buffer is necessary.

So true Debra. Being prepared doesn’t cost much… it is all about creating cash management habits.

One of my goals this week is to set my self a weekly spending budget and a savings budget. These tips will come in handy!

Thanks for sharing

Thank you Luciana. Good work!

Such a great post Ricardina! I totally agree with everything there 100%, especially the saving culture piece. My motto is to always ‘pay myself’ first (i.e. put money away for saving), then pay my expenses and whatever I have left is for spending. This forces you to come up with ways of either earning more money or saving.

Thank you Camela for your input. I really you like your motto.

Hi Ricardina! This was such a helpful post – I feel like I really need to get on top of my finances and start budgeting because I am spending way too much money on make up and things I don’t need! Thanks for this 🙂

Like Camela says in her comment, having a budget forces you to come up with ways of either earning more money or saving. Well done Veronica!

Really good tips, thank you for sharing! I need to prioritize budgeting a bit more